At Richie Capital Group, we take pride in identifying unique undiscovered smaller companies and special situations to invest in. We favor fishing in ponds where other investors do not or may find it challenging to do so. We have found these to be attractive hunting grounds for outperformance. Over the last several years, we have witnessed the broader underperformance of smaller U.S. stocks[1] relative to their larger peers[2]. Given our smaller company focus, this dynamic has remained top of mind. At first glance, it appears that the recent small company underperformance can be explained by the dominance of a few giant mega-cap tech companies, which are so large they are artificially bolstering the returns of their respective market cap weighted indices. However, taking a step back, there’s more to the story. Over the past decade-plus there have been numerous secular tailwinds that have disproportionately benefited the largest of companies. We believe that this dynamic is poised to reverse, and that market dynamics will benefit our portfolio of smaller, high-quality companies and aid us in furthering the outperformance our strategies have experienced over the past decade.

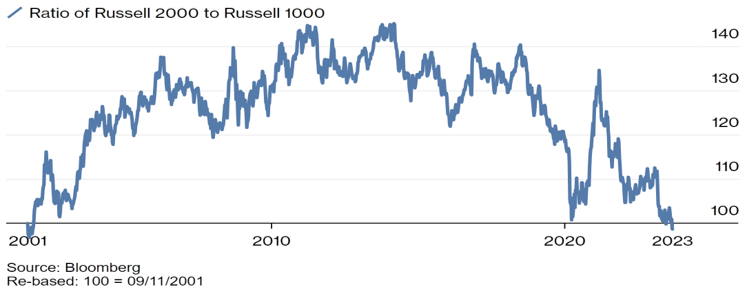

Many readers will be familiar with the Fama and French Three-Factor Model (1992), the seminal research paper by Nobel Laureate Eugene Fama and researcher Kenneth French. The Fama-French model helps describe public equity portfolio performance and predicts, among other things, that smaller companies should outperform larger companies over the long run (referred to as the “size factor”). This concept has long been accepted as immutable truth. However, over the past decade the size factor has seemingly taken a hiatus, with smaller companies significantly underperforming larger companies[3].

Figure 1: Ratio of Small Company performance divided by Large Company performance.

This leads to the logical questions: has something changed since Fama and French published their research and thus the size factor no longer exists? And, if the size factor is still relevant, how long do investors have to wait to reap the benefits?

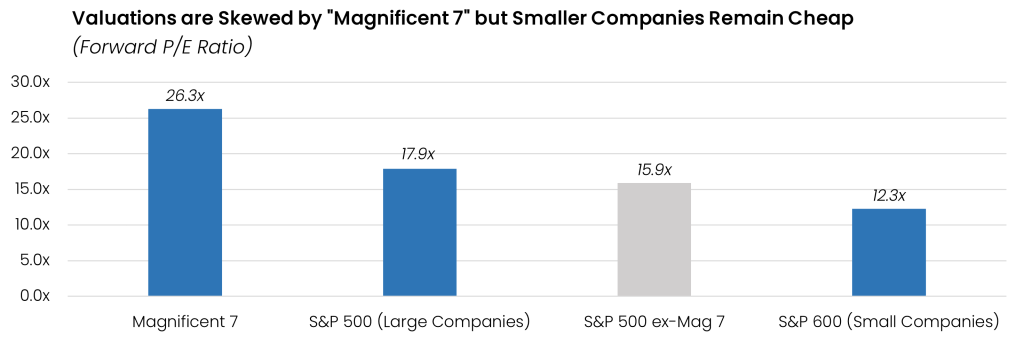

The answer begins at the top, specifically what many call “Big Tech”, “FAANG Stocks”, “Megacap-8”, or what has recently been rechristened the “Magnificent 7”[4]. Compared to smaller indices, where index performance is driven by a broad composition of stocks, the large market indices are dominated by these few companies which disproportionately influence returns and composition. The large weight and strong performance of these companies has artificially inflated the performance of broad market indices – leading to market cap weighted indices comprised of these giants outperforming relative to indices comprised of smaller companies.

With the market cap of the ten largest companies accounting for more than a third of the entire S&P 500 market cap weighted index, there is an argument that the index is over-concentrated to the extent that it reduces diversification for passive investors. This dynamic also creates a difficult environment for actively managed investment strategies focused on large companies. The largest companies are covered by hundreds of analysts, making it difficult to have a variant opinion that adds value. And with their strong growth, it is near impossible to outperform an index if you don’t own the few juggernauts driving performance.

Over the last 50 years, the impact of the size factor has been very episodic in nature, and history now appears to be rhyming for smaller companies. Smaller companies have historically underperformed for multiple years before rapidly outperforming, typically on the heels of a recession or economic slowdown. Small companies act as the “tip of the whip” – generally leading stocks down during an economic slowdown but also being the first to snap back during the subsequent recovery. The phenomenon is clear in this exhibit of small company outperformance (size-sorted bottom 30%) vs. large company (size-sorted top 30%) for the 12-month period following recessions[5].

This is relevant today because for the past several quarters, smaller companies have been priced as if a recession is pending or has already occurred – trading at similar forward earnings multiples as in the 2008 Great Financial Crisis (“GFC”). If history is an indicator, this may imply that a rebound is near. For investors who have weathered the last decade of underperformance, history supports that now might be the worst time to shift exposure away from smaller companies, or inversely, a good time to invest in smaller companies.

At Richie Capital Group, we are not market timers. We know what we do best, and we stick to that. We don’t believe the size factor is broken, but as with many aspects of investing, you have to be patient. Fama and French highlighted as much, stating that investors must be able to ride out the extra volatility and periodic underperformance that occurs with smaller companies. To this point, over any selected fifteen-year investment horizon, smaller companies have outperformed larger companies 9 out of 10 times[6]. Our “audacious” crystal ball prediction is we won’t have to wait another fifteen years to see smaller companies outperform.

Our optimism for smaller companies is not purely predicated on “they are too cheap” or “it’s been too long”. The last decade-plus since the GFC has been distinguished by globalization and exuberant monetary policy. This broadly supports all equities, but globalization and low rates disproportionately favor the largest companies. A paradigm shift is occurring which we believe will favor protectionism over globalization and fiscal stimulus over monetary stimulus – reversing the trends we have seen for the past decade-plus.

This shift will have many implications, but the most relevant to our clients is that it will distinctly benefit smaller U.S. based companies. A geopolitically motivated desire to become more independent of China has resulted in a push for American re-shoring. This is a major tailwind for smaller domestic-focused companies, and we believe is just in the early innings. We expect an increase of major domestic projects designed to diversify supply chains away from countries outside the U.S. sphere of influence. We anticipate ample government fiscal stimulus to expedite this process. We do not invest solely based on these broad themes, but we have noted multiple management teams citing the positive re-shoring tailwinds.

Beyond the macro picture, we still believe the universe of smaller companies presents the best hunting grounds for active managers. Valuations are more attractive and, given the broad and diverse performance of small cap indexes, there is ample opportunity for managers to outperform. Within the smaller universe, identifying alpha isn’t guaranteed: there is a wide dispersion between high-quality and low-quality companies, with around 40% of the companies in the Russell 2000 index reporting negative earnings. Many of these companies will never achieve profitability and remain in small company purgatory forever or cease to exist. Smaller companies also tend to carry more risks including: lack of supplier diversity, customer concentration, and a host of economic disadvantages to their larger peers. This laundry list of risks creates an opportunity for the discerning investor willing to separate the wheat from the chaff.

Our current environment presents an exceptional opportunity for thoughtful active investors to invest in smaller companies. The opportunity set is as robust as ever and we continue to identify, analyze, and own attractive businesses at compelling valuations, that many others are overlooking. Our strategy of focusing on high quality businesses, and having a longer holding period, has served us well and will continue to be a key ingredient in outperforming as market dynamics shift.

[1] We define smaller companies as companies with a market cap of less than $20 billion.

[2] To be clear, our portfolios have outperformed, but the broader small company indices have not!

[3] The Russell developed indexes are treated as the industry standard for following size effects. Large companies are represented by the Russell 1000 which covers the largest 1,000 stocks in the US by market cap, while small companies are represented by the Russell 2000, which covers the stocks ranked from 1,001 to 3,000 in terms of market cap size.

[4] Alphabet (GOOGL), Amazon (AMZN), Apple (AAPL), Meta Platforms/Facebook (META), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA) (Sometimes including Netflix (NFLX) as the 8th company)

[5] Source: Kenneth R. French Data Library

[6] https://www.msci.com/www/blog-posts/small-caps-have-been-a-big/03951176075

Leave a Reply