The year ended on a positive note. Notably, in 2024, the market experienced the best two-year stretch in 25 years. We commented in our 2023 year-end letter that we expected 2024 market performance to be driven by interest rates and inflation. That proved to be true despite negative headlines determined to rain on the parade:

- Inflation lingered

- Only 3 rate cuts in 2024, well below the 6 predicted

- An expanded Middle East conflict

- A rapid unwind of the Japanese Yen carry trade

- A former President was convicted

- A current NYC Mayor was indicted

- Multiple mass shootings

- Multiple Trump assassination attempts

- Expansion of the Ukraine conflict to include Iranian technology and North Korean soldiers

- A monstrous hurricane Helene devastated the Southeast

- Assassination of a healthcare CEO

None of it mattered.

We endured one of the most hotly contested elections in U.S. history. And we thankfully managed to achieve the best possible outcome: a clear and decisive winner. Prior to the election, our firm had two retail clients reach out to us expressing panic about their portfolios if their preferred candidate did not win. And these two had opposite preferences! What is obvious now, and we seem to continually relearn the lesson, is that the market doesn’t care whether the president is Republican or Democrat.

Data from 1926 through 2023. Unified government means that the Presidency, the House of Representatives and the Senate are all controlled by a single party. Divided government means that at least one houses of Congress or the Presidency is controlled by the other party. For educational purposes only. Source.

It’s much deeper than that. The market just wants clarity on how the economy will fare, and the market will adjust.

Certainly, we experienced a “Trump Bump” in the weeks after the election as the market baked in lower corporate taxes (positive to earnings[1]), easier finance regulations (helpful to banks), reshoring (helpful to manufacturers), and protectionism (helpful to domestically focused small cap companies with less to lose in a trade war). However, this bump has now faded with the reality that these policies could re-ignite inflation and lead to fewer future rate cuts.

The market moves forward. The market is highly emotional but, at the end of the day, market performance is still, and will always be, about the economy: earnings and interest rates.

Investors can always find sound reasons to panic. One of my favorite charts highlights, over a 65 year period, the many reasons an investor could have cited to exit their investments. Despite negative headlines, the market focused on fundamentals and always found reasons to recover.

As we look ahead to 2025, our outlook is positive. Consumer spending remains healthy, and corporations continue to make investments in equipment and IP. Employment remains strong with the labor market adding 256,000 jobs in December. Inflation, while still above the Fed’s 2% annual target, appears to be tamed compared to the peak of 9.1% experienced in 2022. We are in the camp that the last mile required to reach the 2% inflation goal may take longer than expected, which could keep interest rates higher for a longer period. However, the outlook for the US economy continues to be strong with no signs of a major slowdown in the coming year.

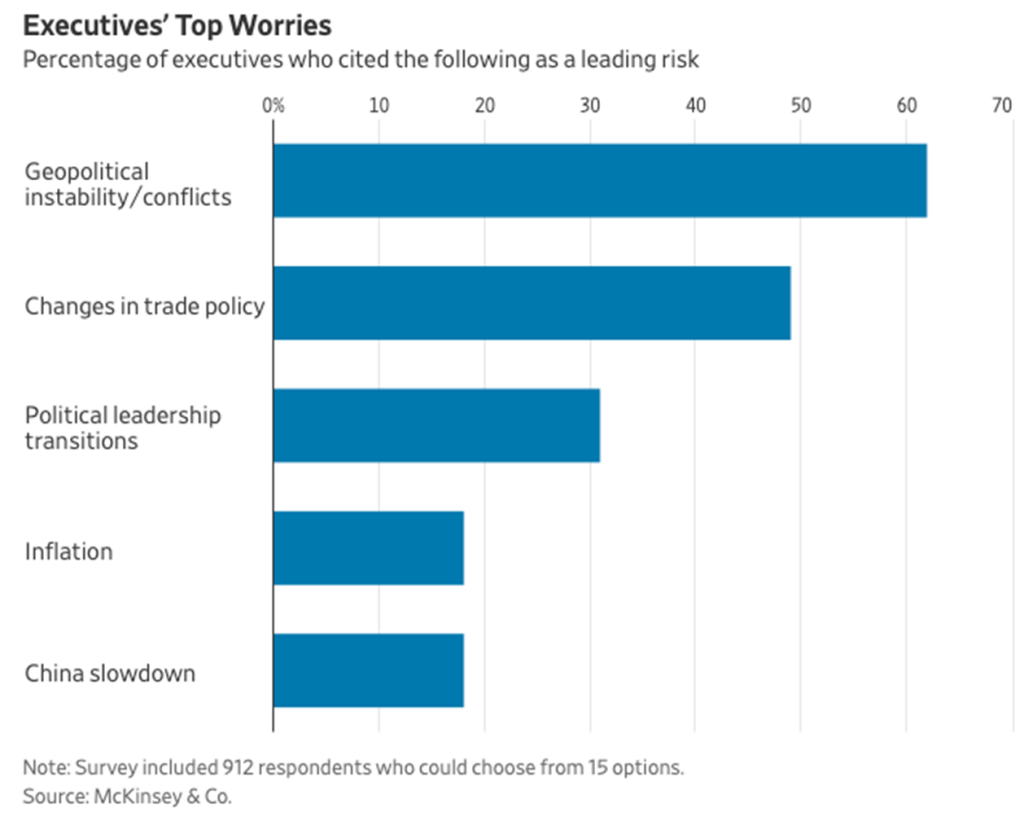

Risks to our positive outlook include:

- Geopolitical conflict in Ukraine and the Middle East

- Government debt and the expanding deficit

- Re-ignition of inflation from changing economic policy, and

- China

Market consensus suggests that valuations are stretched, and we agree. However, valuations have been stretched for some time and often remain so until earnings catch up or an event causes a sharp market correction. Elevated valuations leave the market vulnerable to disappointment but don’t predicate a decline. Instead, future market increases will more likely be driven by earnings growth rather than multiple expansion.

Valuations in our small and mid-cap universe remain attractive relative to larger-cap peers, and we plan to stick to our investment thesis: identifying attractive, under-the-radar businesses with strong fundamentals, robust cash flow generation, and capable management teams. These types of businesses tend to be durable and deft at navigating challenging macro environments. In the current market, froth is unavoidable and so, in 2025 we expect to see a resurgence of companies with unproven business models, meme stocks, and euphoria around “the next big thing.” We continue to believe this is a stock-pickers market where the edge doesn’t come solely from identifying winners, but also from skillfully avoiding the losers.

At Richie Capital Group, we are high conviction investors. We perform in-depth fundamental research that supports our decision making and our approach to holding investments for the longer term. We have a disciplined sell process supported by our broader risk management process. Our sell decisions are not driven by news events or macro forces, but by the fundamental research we undertake for each unique investment.

We are patient investors as we endeavor to generate compounding returns through long-term holdings. We monitor progress through KPIs which we determine during our research process. We consider ourselves business owners, and weare invested in a company and not a stock ticker. Our decisions are based on our current expectations for the company and how it fits into the portfolio. When we consider a sale, we have a laundry list of questions we ask, but they can be summarized in two:

- Does the company have a brighter future ahead than in its past?

- Is there a new investment opportunity better than this existing investment?

We make exceptions when valuations become extreme. But in general, we continually look for any deterioration in fundamentals or in the industry in which the company is competing.

In conclusion, as the world emerged from covid and inflation, the US has out recovered the rest of the developed world. The US has experienced accelerating economic growth and full employment with no perceived effect from restrictive monetary policy. AI and restoring are driving a surge in corporate and research spendingOur conclusion is that if we are unlikely to experience a recession, then the most likely outcome for stocks in 2025 is positive.

[1] Economists predict that cutting the tax rate to 15% would boost S&P earnings by ~4%.

Leave a Reply