After a deep negative shock in Q1, stocks rebounded to a new record high to close out June. The market is convinced that any worst-case scenarios from tariffs or economic policies will be avoided, and investors remain bullish with the unspoken belief that Trump’s policies are more bark than bite.

At face value, promises to slash the federal workforce, impose sweeping tariffs, deport 5 million illegal immigrants, and cut $2T from the federal budget should be a drag on economic growth. But, thus far, delivery has been short of promises and the economy has endured. Job growth is stable, unemployment has hovered around 4%, and Q1 Earnings were “better than feared”. Management teams avoided difficult forecasts by admitting they simply do not know. Earnings broadly met expectations, but management emphasized that consumers are under pressure:

McDonald’s CEO Chris Kempczinski – “Unlike a few months ago, QSR traffic from middle-income consumers fell nearly as much, a clear indication that the economic pressure on traffic has broadened.”

Altria Group CEO Billy Gifford – “We certainly are seeing the consumer under pressure. And we’ve been noting it for a number of quarters, as you recall. It’s the cumulative impact of the inflation. It’s not just one quarter standalone. It’s the cumulative impact over time.”

Procter & Gamble CFO Andre Schulten – “So what we’re seeing, I think is a logical response from the consumer to pause. And that pause is reflected in retail traffic being down. It’s also reflected in somewhat of channel shifting in the search for the best value…”

The biggest near-term obstruction to the economy is uncertainty. Companies have no visibility which limits their ability to plan or invest. While we hope that the new administration’s economic shift proves “better than feared”, the real effects won’t surface until at least the fall. It takes time for companies to adjust their pricing to match costs and demand. And the first signs of tariff impact won’t be inflation, they will be empty shelves, shipping delays, and slowed information flows. After “Liberation Day”, companies were reluctant to invest or place orders with countries subject to high tariffs. These decisions (or lack thereof) will take six to nine months to impact inventories. Higher prices and a slowing economy will follow.

It’s no surprise Chairman Powell is hesitant to act. Compared to last year, the Federal Reserve is more reluctant to cut interest rates with the lingering specter of unsurfaced inflation from unclear trade policy. We hope that the outcome here is also better than feared, but our deeper concerns are rooted in debt.

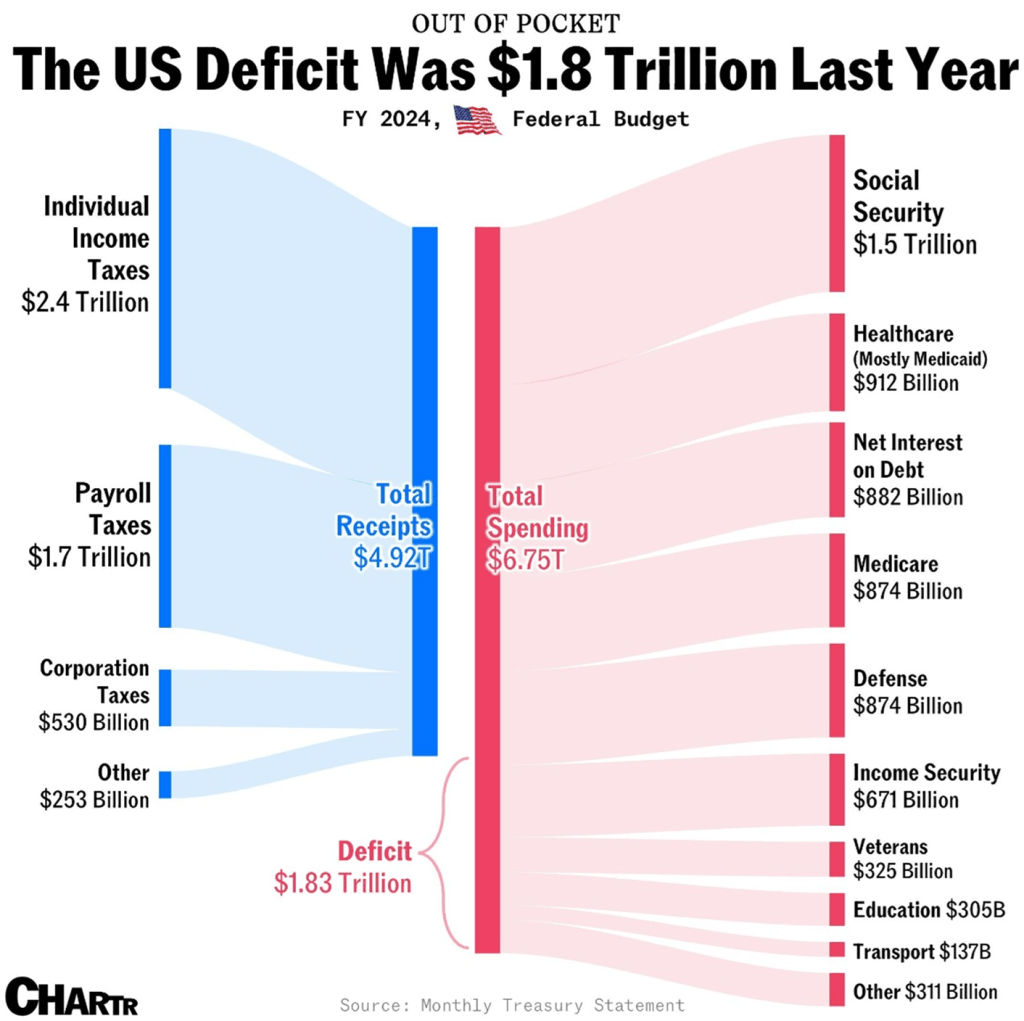

The U.S. national debt is growing faster than the economy. Like many reading this letter, I dismissed news reports about massive deficits as political theater and shrugged it off. Not my concern. They will figure it out. However, a recent infographic gave me pause: the government’s third largest budget expense is currently the net interest on our debt.

The chart made the problem clear. According to the U.S. Bureau of Labor Statistics, the top 5 expenses for the average American household are housing (33%), transportation[1] (16%), food (12-13%), insurance and pensions[2] (12%), and healthcare (8%). The above chart would be the equivalent of a family’s credit card interest payment (not principal) each month being larger than their spending on food, insurance, or healthcare. Also notable is that net interest is edging its way into second place. That is inconceivable and unsustainable.

In three years, the U.S. debt to GDP ratio will hit a record high not seen since World War II[3].

Source: Congressional Budget Office

The recently passed tax and spending bill is projected to add roughly $3.4 trillion to the deficit over ten years and amplifies the gravity of our “credit card problem”. The question to ask is if we worked our way out of our debt problem after World War II, can we do it again?

Short of default, there are three basic mechanisms to reduce a country’s debt-to-GDP ratio:

- Grow the economy faster than the interest rate on debt,

- Inflate the debt away with higher inflation[4],

- Enforce fiscal discipline and run primary surpluses.

Our research suggests growth alone won’t be enough, and inflation may offer less relief than in the past since interest rates are likely to rise in tandem. Ultimately, the only reliable solution will require some combination of raising revenue (taxes) and decreasing spending. It’s also important to remember that the size of our debt ($269B vs $35.5T)[5] and the size of our GDP ($243B vs $29.7T) then vs now means that reducing the debt or accelerating GDP growth will require significantly more effort. And that effort again points to fiscal discipline. The current administration has taken some steps to solve the problem, but others are highly counterproductive. To be clear, this isn’t a problem to be solved by one administration, but kicking the can will only work for so long.

What does this have to do with stocks?

One counter to the “household credit card” analogy is that, unlike American citizens, the U.S. Government can literally print money. The U.S. borrows money by issuing Treasurys. Flooding the market with them drives yields upward as buyers demand higher rates for increased risk. Because Treasury yields anchor other forms of debt, this pushes up rates on mortgages, car loans, and corporate bonds. Higher cost of capital decreases the value of stocks, real estate, companies, and the entire economy. It is critical that we get this right. Over the long term, our inability to maturely manage our “credit cards” could irreversibly erode the world’s faith in the U.S. financial system.

[1] Includes: Vehicle purchases, gas, insurance, maintenance, and public transportation.

[2] Includes: Health insurance, life insurance, and contributions to Social Security and retirement plans.

[3] https://www.federalbudgetinpictures.com/public-debt-high/

[4] Our understanding is that the Trump Administration is attempting a combination of #1 and #2

[5] https://www.investopedia.com/us-national-debt-by-year-7499291

Leave a Reply