Company: Viemed Healthcare, Inc. (VMD)

Sector: Healthcare – Healthcare Equipment

Price/Market Cap: $9.85/$358M

Target Price/Implied Upside: $15/52%

Thesis

Specializing in respiratory healthcare services, Viemed Healthcare (VMD) is a fast growing, free cashflow generating business serving an underserved niche market with tremendous runway ahead. VMD is building a moat by developing strong relationships with hospital systems and doctors while generating cost savings benefits to the healthcare system.

Catalysts

- Recently Medicare approved and licensed in 11 additional states to extend their coverage area to 46 states.

- Recently approved to provide care for the Veterans Affairs (VA) Health System

- New investor pool: Recently listed on the Nasdaq and added to the Russell 3000 Index which eliminates the confusion of a US company solely listed on the TSX.

History

- Founded in 2006 by founders Casey Hoyt and Michael Moore to focus on respiratory illness.

- Founders sought capital infusion and were acquired by Patient Home Monitoring (renamed Protech Home Medical) in 2015.

- Spinout from PCH in December 2017 as a TSX Venture Company.

- Uplisted to the full TSX in 2018.

- Dual Listed to Nasdaq in August 2019.

- Added to the Russell 3000 Index in June 2020.

Company

Based in Lafayette, Louisiana, Viemed Healthcare is a US based, specialized respiratory healthcare services company focused on Chronic Obstructive Pulmonary Disease, commonly referred to as COPD. COPD is an umbrella term used to describe a group of progressive lung diseases including emphysema, chronic bronchitis, and refractory (non-reversible) asthma. Many patients have multiple conditions. The disease is characterized by increasing breathlessness which progresses over time. There are different types of COPD. Each type may affect how well different treatments work, how symptoms affect everyday life, and how they progress. If a patient has a co-morbidity such as high blood pressure, heart disease, heartburn, depression, or diabetes, this can also affect how the disease manifests. There are no current cures for the disease nor are there specific clinical trials that will solve the problem. According to the CDC, COPD is the fourth-leading cause of death after heart disease, cancer, and accidents.

Including undiagnosed sufferers, COPD affects over 25 million Americans. The cost to treat patients diagnosed with COPD is estimated to be $30B a year. Oxygen therapy is the only COPD therapy proven to extend life. However, prior to the launch of Philip’s Trilogy line of portable ventilators, treatment was only conducted in hospitals with expensive overnight stays. These ventilators allow patients to breathe more comfortably while letting the lungs rest and recover.

Over 1 million COPD patients were admitted to US hospitals for acute exacerbation in 2012. Of those, 23% of cases were re-admitted to a hospital within 30 days and 49% within 60 days. Through the use of a Non-Invasive Ventilator (NIV), which dramatically reduces the rate of re-admits, the savings to hospitals and payers is dramatic. The U.S. healthcare system is driven by reducing hospital admissions and continues to focus on finding value-based home care providers. This trend is especially important on the back of a pandemic as the Viemed solution frees up hospital beds for Covid-19 patients.

Business model

Viemed’s primary business is leasing health equipment for home use. Specifically, the company specializes in delivering Non-Invasive Ventilators (NIVs) to patients suffering from very severe (Stage 4) COPD. VMD acquires these NIVs from multiple vendors (including Philips and Resmed) for $6,000 to $6,500. They then lease these to customers with a doctor prescription for in-home use and are covered by Medicare and private insurance at a rate of $950/month. (7-8 month payback) Pricing includes equipment rental, RT service, supplies and maintenance of equipment. The rental contract is uncapped. However, the average lease length is 17 months. Upon termination of the lease, VMD refurbishes each NIV with minimal costs and can continue to lease each ventilator for up to 10 years before it needs to be disposed. VMD maintains a 90% utilization rate for all of their NIVs.

VMD employs a staff of licensed Respiratory Therapists (RTs) who act as both sales staff and in-home support for COPD patients. The RTs develop relationships with doctors and hospitals within their assigned regions and are responsible for supporting patients after doctors prescribe the VMD home therapy. The RTs provide patients with in-home respiratory care services, equipment setup, training, and provide on-call 24×7 support for each patient.

This high touch approach is also a differentiator for their business. No competitors in the market provide this comprehensive solution. Additionally, the company has developed a mobile app with educational resources as well as a portal for patients to interact directly with their prescribing physician.

The in-home solution reduces costs to the healthcare system and improves outcomes for patients versus in-hospital treatments. The Company has funded multiple studies[1] to prove their benefits:

- $25k in savings per patient through home treatment and no hospitalization.

- Mortality reduced by 42% and, for every 6 patients placed on VMD therapy, they save a life.

Licenses

The company currently operates in 35 states. They are Medicare approved in 46 and licensed in 48 states.

Addressable Market

The American population continues to age. There are roughly 80M American Baby Boomers reaching retirement age at a rate of 10,000 per day for the next 19 years. There are believed to be some 25 million people in the US suffering from COPD including undiagnosed cases. 10% of these cases have Stage 4 COPD which is the segment VMD addresses. For Stage 4 patients, 50% have chronic respiratory failure leaving 1.25M treatable patients who would benefit from Viemed. This represents $20B in revenue up for grabs and the Company believes that 95% of the market is still unpenetrated relying on hospital admission to address an acute patient crisis.

VMD has barely scratched the surface for penetrating their licensed markets. And given that VMD still sees room for growth in their first market (Lafayette, LA), there is plenty of runway available for the company for many years to come.

Opportunities

VMD recently announced the approval of a contract to serve the Veterans Affairs (VA) Health System with funding provided by federal legislation. Management estimates that there are in the range of 300,000 to 600,000 U.S. military veterans with advanced COPD who are now candidates for VMD’s services. This is a tremendous opportunity that the company has been pursuing for the past few years. Their national contract is through a Veterans Care Agreement (VCA). None of their competitors have this contract in place as they are not easy to receive, and many companies try to avoid serving the VA because of the complex process to get in and the bureaucracy involved.

Outside of their existing unpenetrated markets, the next logical opportunity is in the area of Pediatrics. Children are a different type of patient, and VMD can offer both invasive and non-invasive vents with a margin profile similar to their existing business. The market is also attractive as their therapy treatments can prolong the length and quality of life for children beyond the 17-month average lifecycle for adults treated with ventilators.

VMD’s long term goal is to become the premier healthcare tech business in the country.

Competition

Viemed is the largest independent provider of NIVs and related services in the United States. The two largest national competitors are Apria Healthcare and Lincare. Outside of the big 3, the market consists of local and regional “Mom and Pop” operations. VMD has distinct advantages over both categories of competitors.

Both Apria and Lincare are organized to be one stop shops for home healthcare. They provide products ranging from respiratory care, to sleep management, to home infusions, to wound therapy. They do not specialize in respiratory care. More importantly, neither company offers the comprehensive, high-touch therapy solution that VMD does consisting of 24×7 on call RT attendance and a mobile portal providing direct access to the physician. Both Lincare and Apria are structured to sell, and deliver, products. VMD provides a full suite of home care for patients which is attractive to the prescribing doctor. Many of the local and regional Mom and Pops offer a comprehensive homecare plan. However, none of them are licensed and accredited across multiple states nor do they have the financial resources to invest in the costly process. As VMD gains scale, they will have additional leverage over the competition.

When entering a new territory, Viemed RTs most often encounter hospitals and doctors without a home solution. (And thus, management views “do nothing” as their biggest competitor.) Patients visit the hospital with acute symptoms, they are treated in the hospital (often staying a day or two) and they are released with a drug prescription only to repeat the cycle in a few weeks or months when the acute symptoms flare up again. This is costly and ineffective when the Viemed home solution allows the patient to be treated in their own home in a cheaper, yet more effective manner. VMD can consistently enter a new market and dominate by ramping up quickly and separating themselves from competition through a combination of service, specialist expertise, and resources.

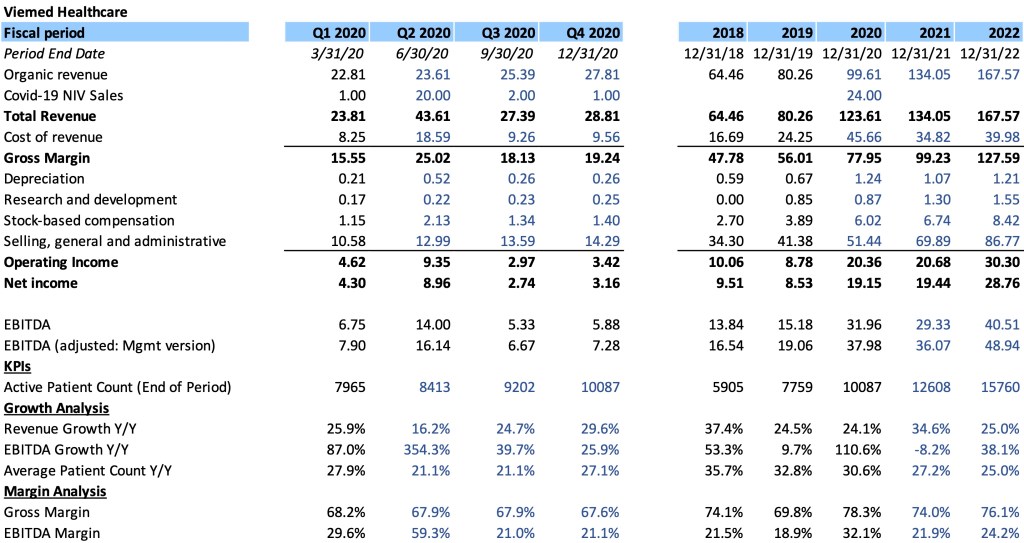

Financials and Valuation

Viemed is still early in its growth phase as they work aggressively to grab market share and educate hospitals around the nation about the efficacy and cost savings from their NIV solutions. Management believes that they can continue to grow at an average rate of 2-3% per month (30-40%/year) maintaining similar margins for the foreseeable future, and they believe they can eventually grow 6x to 8x their current size.

We have modeled a more conservative growth rate and see value in the investment with annual patient count growth in the 20-25% range. There is some seasonality in the business. Summer months are trending a bit slower as patient acute symptoms ease with warmer weather. Covid-19 has presented both a headwind and opportunity. Through the crisis, hospital systems are slower from a combination of reduced staffing and patients doing all they can to avoid entering hospitals. In the interim, Viemed is fulfilling requests for direct sales of ventilators to address hospital shortages. These sales will not be an ongoing business line, but they are an opportunity to build loyalty with health systems and establish the company as the go to resource for respiratory related health equipment. As the hospitals stabilize from the crisis, we expect some catch up demand for the leasing business in the fall and early 2021.

VMD currently trades at a significant discount to peers in the sector. We believe this disconnect is due to a continued negative association with Protech Home Medical and a lack of a shareholder base. Management has attacked this issue directly and completed an uplisting from the TSX venture exchange to full TSX (2018), dual listing on Nasdaq (August 2019) and inclusion in the Russell 3000 index (June 2020).

We value the company at $15/share by applying a 20x EBITDA multiple (25% discount to current peer range 26x EBITDA) to our 2021 EBITDA estimate of $29M[2]. We assume management’s most recent statement of $9.5M in long term debt and $8.4M in cash. The multiple is rich on an absolute basis, but we view it as fair given the growth rates and tremendous addressable market available for expanding both geographically and in density. Top executives own ~13% of the company.

Risks

The key risk with this company is if Medicare decides to arbitrarily reduce reimbursement rates as they did in 2015. This impacted margins and bottom line until the company was able to make adjustments and margins rebounded. We view the likelihood as low given the current pandemic and the fact that they reduced rates as recently as 2015. Outside of this, there is typical execution risk and the question of management’s ability to handle the exponential complexity that comes with growth at this rate.

[1] https://www.viemed.com/industry-research/

[2] Our internal EBITDA measurements differ from management estimates primarily because we do not add back stock-based compensation. It should rightfully be reflected in SG&A as a part of salary. For VMD specifically, management has noted that a key rationale for going public was the ability to attract and reward employees with stock.

Leave a Reply