The equity markets ended 2023 in a strong fashion with the broader S&P 500 index up 24%[1] for the year. This was the second year in a row where market performance was dictated by interest rates and inflation. The outcome is notable because, at this time last year, we were fully prepared for a recession in 2023 or early 2024. In fact, a recession wasn’t just likely but inevitable as the economy was experiencing early signs of sluggish growth and there was an inherent expectation that beating inflation would be painful. Historical data supported this notion as the American economy had never experienced such a sharp increase in interest rates (500 bps in 15 months) without an accompanying recession. The only remaining question was how deep would the recession be?

Forecasters predicted it, but it didn’t happen. During the first three quarters of 2023, consumers continued to consume, growth averaged ~3%, and inflation slowed substantially. All the while, unemployment remained near historic lows at less than 4%. For perspective, the US has the lowest inflation across the G7 nations but has maintained the strongest economic growth. Reducing inflation without a drastic hit to jobs is a substantial feat, and the Fed should be commended. What we are seeing in the market today (US economy slowing gradually, and unemployment starting to rise) is fully consistent with an eventual recession, but also with a milder outcome which we could easily classify as a “soft landing.”

Given the positive trajectory of the economy, it would be reasonable to expect cheers from American consumers, or at least one of those weird, awkward claps that passengers perform when their plane lands safely after turbulence. The reality is that most consumers don’t feel great about the current environment. Despite our economy moderating, the average consumer doesn’t feel better off than they did a few years ago because they are still adjusting to the new normal in prices elevated by inflation which peaked at more than 9%.

The White House argues that a hot labor market has boosted wages more than prices, so workers should be better off. The reality is that since 2020 prices have risen by roughly 20% and average wages have risen slightly more. But for many families, the cost of living is driven by the prices of housing, groceries, utilities, and credit. Housing is less affordable than it’s been for years because of higher rents, home prices, and mortgage rates. Since 2020, groceries are up by 25%, the food budget is up more than 20%, and consumers can’t seem to accomplish any task without being asked to leave a tip! In other words, households do not just feel worse off; they are worse off. And the higher cost of living is most painful for those who are on a fixed income.

There is also a general sense of unease. The American economy is fine, but Americans not so much. Consumers are spending, but increasingly shopping around for the best prices. Over the summer, Americans saved less and their incomes, adjusted for inflation, fell. Small businesses are feeling the acute impacts of the rising costs of borrowing. Small businesses spend a greater share of revenue on interest payments than their larger peers, creating stress that larger companies do not experience. Earlier this year, the Fed’s quick interest rate increase squeezed banks who had taken on too much duration risk. The most vulnerable were the medium sized US banks which led to the insolvency of Silicon Valley Bank and later the fire sale of Credit Suisse. A true crisis never materialized, but the underlying concern for a crisis lingers. The war in the Ukraine continues with no sign of easing and, for good measure, we have added a new conflict in the Middle East. 2024 will showcase a US presidential election with the potential to upend the world order: for the first time in 80 years, a protectionist and isolationist America no longer in NATO is a distinct possibility.

What’s ahead?

Despite the current malaise, we see reasons to be bullish on stocks in 2024. Our biggest concern is that the market may have jumped the gun regarding the timing and frequency for FOMC rate cuts this year. As of this writing, the market has priced in five to six rate cuts, with the first happening by the end of March. The Fed doesn’t want to make the same mistake where they reacted too slowly to address surging inflation by waiting too long to lower rates to ensure inflation is fully extinguished. Waiting too long could tip the economy into recession, while cutting rates too soon might allow for inflation to reignite.

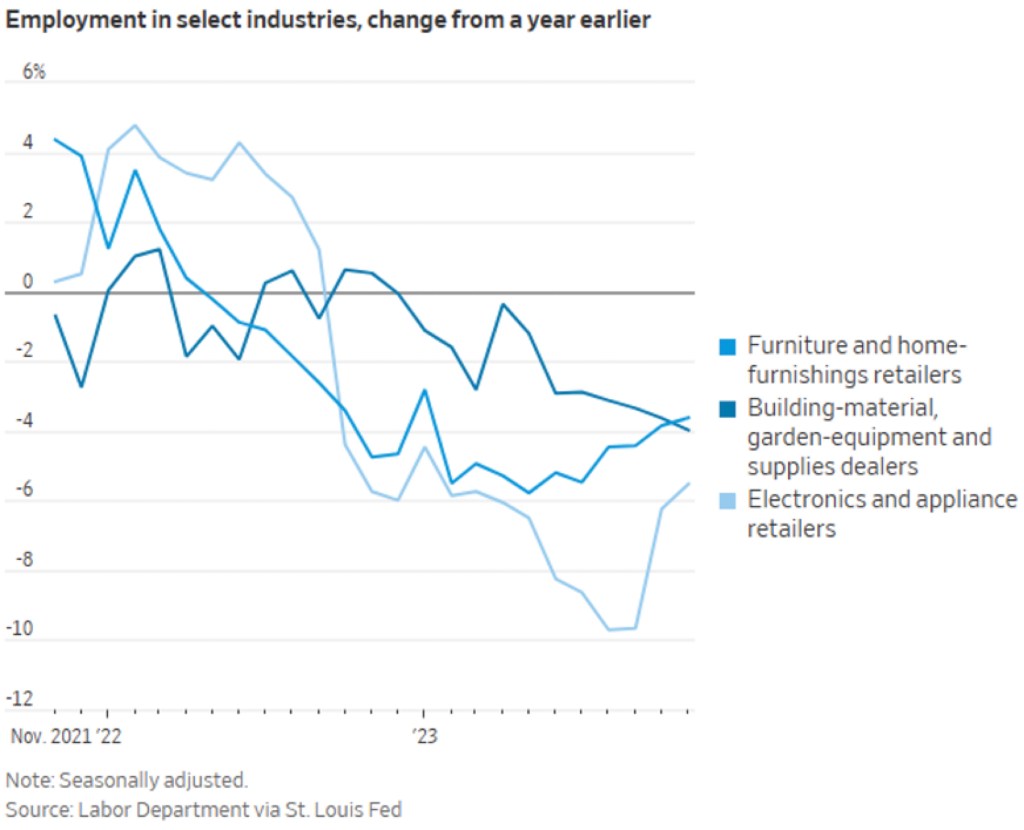

It is our view that the Fed’s work Is mostly done. Interest rate increases take some nine months to reflect in the economy. Given that the last increase was at the Fed’s July 2023 meeting, we have yet to see the full impact. Additionally, housing is likely to perform the remainder of the work to reach the 2% target. Shelter inflation is based on rents (as opposed to housing prices) and, according to Zillow, rent growth over the past year has fallen to 3.3% through November. There is a lag in this data because tenants’ rents change just once a year when their lease ends. So even when the prices for food and consumer goods stop rising, rents should maintain downward pressure on inflation in 2024. And beyond rents, we are likely to see a ripple effect within the housing ecosystem. House prices are likely to fall as home buyers face higher financing costs. Until that time, the current deep freeze in the housing market (buyers balking at high prices and sellers unwilling to give up their 3% mortgages) will slow economic pace and there will be less spending on industries tied to housing including retail, furniture, electronics, and home improvement.

And in the end, Jerome has your back! What was most bullish about Powell’s December Fed meeting commentary was his flexibility. He implied that if he noticed a slowdown in the economy, he would lower rates. He’s not going to be as stubborn on the way down as he was on the way up. The perception that he is prepared to lower rates is more important than whether, or when, they are lowered.

This is positive for stocks and the stock market. We are hopeful that we are permanently leaving the era of super low interest rates. This will ensure more government discipline as governments can’t run large deficits when interest rates on debts are high. We also believe the market is primed for more institutional interest in public equities. Private equity (buyouts, growth, and VC) faces challenges in fundraising, a dearth of exit paths for portfolio companies, and lower expected returns in a high interest rate environment. Under the circumstances, returns via liquid public equities should become more attractive to investors.

As we discussed in our last letter, within public equities, we view this as a moment for smaller companies to shine. There are multiple tailwinds supporting their growth, and higher interest rates will allow better managed companies to outperform their financially challenged peers. We are already seeing signs of market breadth expanding as investors begin to shy away from the Magnificent 7. This points to a stock picker’s market and a unique opportunity for skilled investors to differentiate themselves. There is always the potential for a downside surprise, but we believe we are entering a true Goldilocks environment for public equity investors, specifically, investors focused on smaller companies.

[1] However, only +10% excluding the Magnificent 7.

Leave a Reply