I recently read an article highlighting one of Warren Buffett’s early investments in a company called Western Insurance. I found a more detailed description of the transaction in a Buffett biography:

“As much as he liked GEICO, he had made the wrenching decision to sell it after finding another stock that he coveted even more, called Western Insurance. This company was earning $29 a share, and its stock was selling for as little as three bucks. This was like finding a slot machine that would come up cherries every time you played. If you put in twenty-five cents and pulled the handle, the Western Insurance machine was virtually guaranteed to pay at least two bucks. Anyone sane would play that slot as long as she could stay awake. It was the cheapest stock with the highest margin of safety he’d ever seen in his life. He bought as much of it as he could, and he cut his friends in on the deal.” – “The Snowball: Warren Buffett and the Business of Life,” Alice Schroeder

I read the story over and over in awe. A quick translation is that the Western Insurance stock was trading at a P/E ratio of ~0.1x. Compare this to modern stocks Google (26x), Meta/Facebook (35x), and Nvidia (74x). What an absolute slam dunk, can’t lose, investment opportunity! Buffett made this investment in a perfectly healthy Western Insurance company during the 1950s. But it wasn’t easy for him to find as cheap stocks weren’t advertised. He had to do a ton of digging in publications and catalogues to find it. Buffett, and his mentor Benjamin Graham, had a habit of finding stocks at rock bottom prices. In the modern digitized era, thousands of analysts worldwide can leverage Bloomberg terminals and stock screens to quickly find a company selling that cheaply. And thus, it’s nearly impossible to find healthy companies trading at that significant a discount. You would do a lot of wheel spinning attempting to duplicate Buffett’s feat. However, we believe there are still advantages enterprising investors can exploit to outperform. One of these advantages is time.

In previous letters, we have discussed why we focus on smaller companies, and why we believe concentrated portfolios are an essential element for long-term outperformance. Another core tenet of our investment philosophy is long-term holdings. We believe that time arbitrage – the concept of taking advantage of investors’ short-term overreaction to news with little impact on long term prospects – is a superpower. When a high-quality company is sold down due to an earnings miss, management change, regulatory issue, or peer failing, the Market will likely overreact to the negative news. Industry incentives pressure market participants to focus on short term factors impacting companies to the exclusion of long-term potential. Time-arbitrage is a means to exploit the fact that most investors have short time horizons and rapidly turn portfolios.

At Richie Capital Group, we focus on the longer term. Because we view each investment as partial ownership of a real company, we want to own our positions for at least three to five years. Our best investments are those we have held for 10+ years. In the battlefield of investments, time is a powerful ally.

“The longer you can extend your time horizon the less competitive the game becomes, because most of the world is engaged over a very short time frame.” William Browne, Chairman of the Board of Directors of Tweedy, Browne Value Funds

Maintaining a long-term focus provides us with numerous advantages:

- Capital Compounding – Our broad goal as investors is to compound our returns. With each investment, we are seeking to tap into the J-curve of investment growth. As a company grows operating earnings and re-invests those earnings, the result should be a cumulative acceleration in earnings over time.

- Distraction From Market Swings – We ignore short term market movement. If the initial investment thesis hasn’t changed, then why should we be concerned whether the Market believes our investment is worth 5% less (or more) on a given week?

- Focus on Fundamentals – We are focused on the long-term fundamentals of the business. A company’s fundamentals are essentially the company’s medical record and an indication of company prognosis. As we underwrite each investment, our deep understanding of the competitive advantages, growth potential, addressable market, and management allows us to focus on the opportunity for long-term value creation.

- Reduced Market Friction – Investing with a long-term mindset, reduces the many market frictions including transaction costs, taxes, and the investment mistakes that can come from market timing.

- Moderated Emotions – Short term thinking heightens the impact of emotions. Fear and greed aren’t your friend and shouldn’t dictate investment decisions.

Our strategy is backed by extensive academic research. Consider the findings of a landmark study by Cremers and Pareek: “Patient Capital Outperformance[1].” This paper analyzed the performance of high active share managers who traded their portfolios infrequently (holding duration of over 2 years). The researchers found that the data overwhelmingly showed that investors willing to hold their positions for extended periods outperformed their more active counterparts by 2-3% per year, net of fees, over the long term.

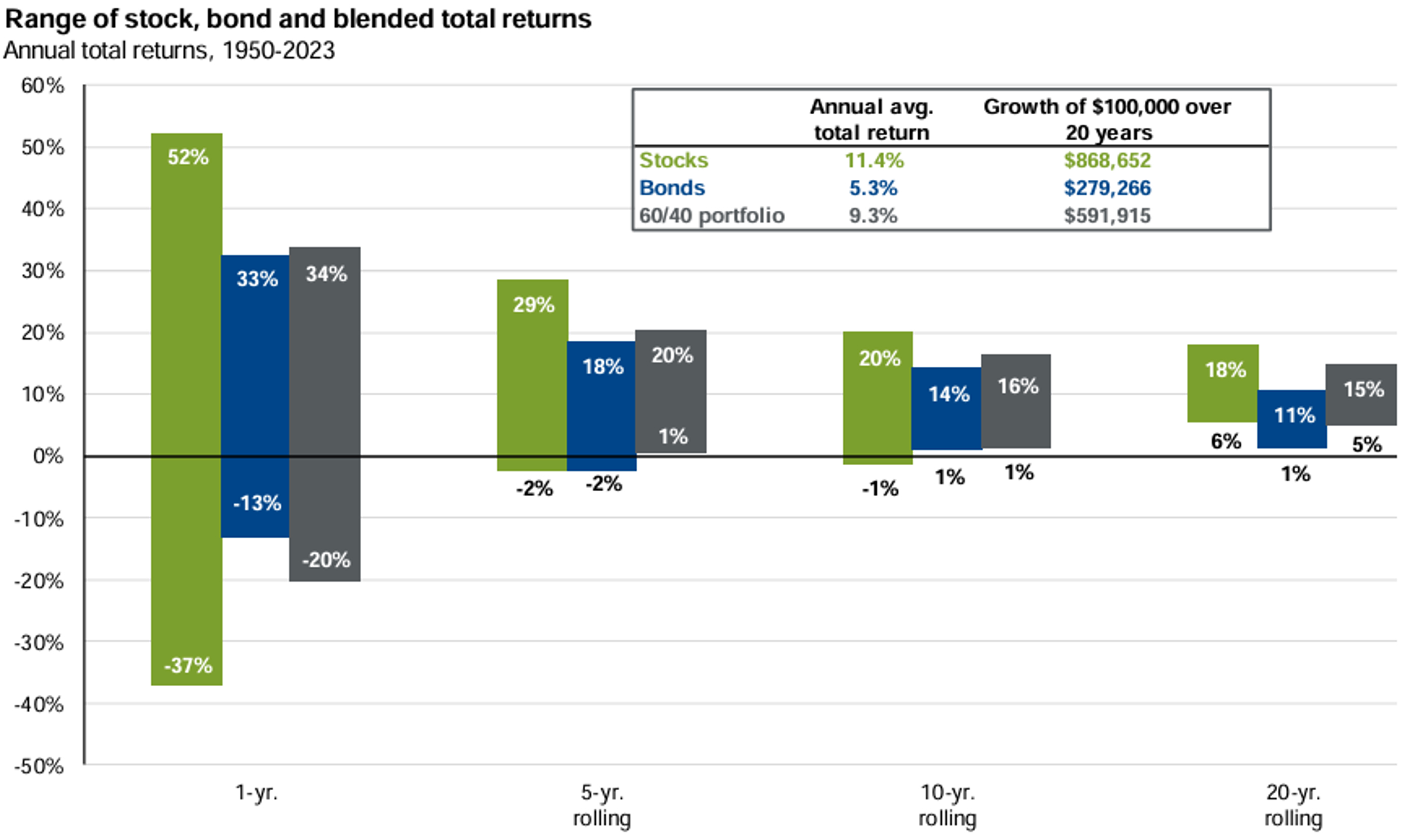

These were not isolated results. The JP Morgan chart below highlights S&P 500 Index returns for the last 73 years (1950 to 2023). Over a one-year period of rolling returns, the best return over that 50-year time frame was +52% and the worst was (-37%). Contrast this with the rolling twenty-year returns which shows that investors who held their index positions for at least 20 years never lost money. The worst an investor could have performed would have been an average of +6% per year, and during the best 20-year period, they would have achieved +18% per year.

Source: JP Morgan Asset Management U.S. 2Q 2024 Guide to the Markets

The data points to an obvious answer, but long-term investing remains a superpower because it is harder than it looks. Over the last 20-year period, an investor would have had to stay the course through tumultuous periods including:

- Chinese Stock Bubble – 2007

- Great Financial Crisis (GFC) – 2008

- Flash Crash – 2010

- European Debt Crisis and US Debt Ceiling/Credit Downgrade – 2011

- Chinese Stock Market Crash – 2015

- US Fed Rate Hikes / Cryptocurrency Crash – 2018

- Covid – 2020

- Russian Stock Market Crash and US Interest Rate Increase – 2022

Courage of conviction through each of these periods would have led to a positive outcome. But most investors (both professional and individual) suffer from an inability to do nothing and are unable to remain faithful to a strategy for decades at a time. The market is inherently volatile, and the roller-coaster during periods of turbulence can feel like the end of the world. History paints a clear picture: over the long haul, time is your friend, and the long-term market trend is upwards.

We take this long-term, patient approach to the next level by constructing concentrated portfolios of our highest-conviction ideas. Focusing our capital on a few select opportunities allows us to deeply understand the businesses we invest in and ride out the short-term volatility that often accompanies a concentrated approach. This patient, disciplined course has allowed us to consistently outperform the broader market. What we do is special and is undergirded by decades of experience analyzing companies from a variety of lenses: strategic, financial, and operational.

In a world that increasingly rewards instant gratification, the virtues of patience and long-term thinking can seem almost trite. But for those of us who are serious about outperforming and growing capital for our clients, embracing a patient, disciplined approach is not just a necessity but a superpower.

[1] “Patient Capital Outperformance: The Investment Skill of High Active Share Managers Who Trade Infrequently”

Leave a Reply