The S&P 500 is up 14.4% for the first half of 2021. Much of these gains were triggered by companies announcing positive earnings expectations for the second half of the year. A record 64% of companies that provided guidance exceeded Wall Street Analyst projections. Most companies have positioned the pandemic in the rear-view mirror and expect things to get better from here. Meanwhile, the Market continues to hit all-time highs, while Wall Street seems to be overly conservative on future prospects. The source of caution stems from expected inflation.

As reported by CNBC[1], US consumer prices in May rose 5% over the year prior, the largest increase since 2008 (shortly before the Financial Crisis). Of note:

- The gasoline index increased 56%

- Used car and truck prices increased 30%

- Existing home prices rose 17%

- Airline tickets increased 24%

- Hotels and motels up 10%

- Food prices increased a modest 2.2%

Much of the above is easily explainable: comparisons to a very weak year. No one was traveling last year during the peak of Covid, and airlines couldn’t give tickets away. Now, vaccines are readily available, restrictions lifted, and people are ready for normal.

More interesting inflation signals come from labor/higher wages[2]:

- Amazon announced it would hire 75,000 more workers (after hiring 500,000 in 2020), while increasing average pay from $15 to $17/ hour and offering $1,000 signing bonuses

- Domino’s Pizza is offering some delivery drivers $1,000 signing bonuses plus $25 an hour

- Chipotle is raising wages to an average of $15 an hour

- McDonald’s is raising wages by 10% for more than 36,500 hourly workers

- FedEx and Cardinal Health are paying $500 sign-on bonuses

The industry trends are not surprising:

The largest increases are in the industries hardest hit by the pandemic. Salaries offered need to be higher in industries where millions were laid off: trust was broken, and incentives are required to bring people back.

The Market is divided with some viewing the above indicators as “transitory,” while others view it as more permanent. Both can be right. With cars, demand is currently outpacing supply due to an ongoing component shortage. Supply will eventually catch up with demand and prices will mean revert. After an initial travel pop based on pent up demand, people will settle back into their normal travel schedules and the post-Covid travel boom will taper off. Transitory.

What is not transitory is salary increases. Cars and flights can go on sale. But when you offer an employee $15 an hour in 2021, you can’t approach them in 2022 with $13.

This can potentially create a vicious upward cycle. If a company has to pay its employees (an input cost) 20% more, they will have to raise prices to cover the added salary burden. If basic consumer staples cost more, consumers feel the pinch and seek higher salaries to maintain their standard of living. Wages and prices then begin to chase each other higher. Eventually, it reaches a point where prices that consumers experience in their day to day lives (gas, groceries, rent) start to drive inflation expectations and perception becomes reality: people start to expect prices to increase even more. And similar to the toilet paper panic of 2020, as people expect prices to rise in the future, they buy in advance today, thus reinforcing upward prices. This was the psychology of the 1970s during the oil crisis[3] and it created crippling inflation.

Real inflation is a significant threat to stocks and investment assets.

The good news is we have a playbook.

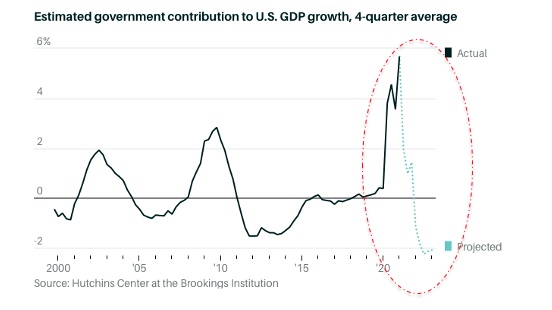

The Economy is recovering faster than expected, and Fiscal policy is projected to transition sharply from boosting growth to holding it back as the economy reopens. This should dampen inflation risks[4].

PPP has ended and enhanced unemployment benefits will end soon. This should end the worker shortage and slow future wage increases. The Fed has already indicated that any further signs of inflation will lead to an immediate switch from boosting growth to holding it back. The Fed has a playbook and will raise interest rates in addition to other measures. The challenge will be managing the throttle so that inflation is harnessed without hitting the brakes too fast or too long which could freeze credit markets and send us back into recession. The pandemic has taught us that we can shorten (or even end) recessions through abundant government spending. Let future generations worry about the debt and deficit! …Hmm

Leave a Reply